Paladin Precious Metals™ (PPM)

Why Invest with PPM?

PAI exclusively offers only ethically sourced “investment” grade precious metals that meet the London Bullion Market Association (LBMA) “good delivery” certification.

We believe precious metals is one of the very few asset classes inversely correlated to the financial markets. Over millennia, gold and silver bullion has a long-established history as a trustworthy long-term investment option (preferred by states, sovereign funds, institutional investors, and individuals). Although arriving late to the party, Platinum has steadily performed as a viable addition to investors’ alternative portfolio choice. Together, these three options give an investor significant diversification and risk mitigation to create a well-balanced portfolio.

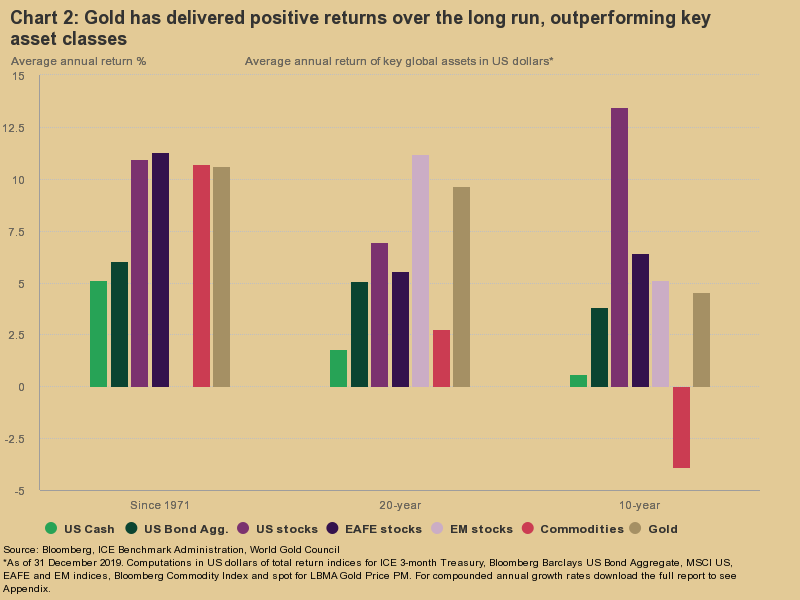

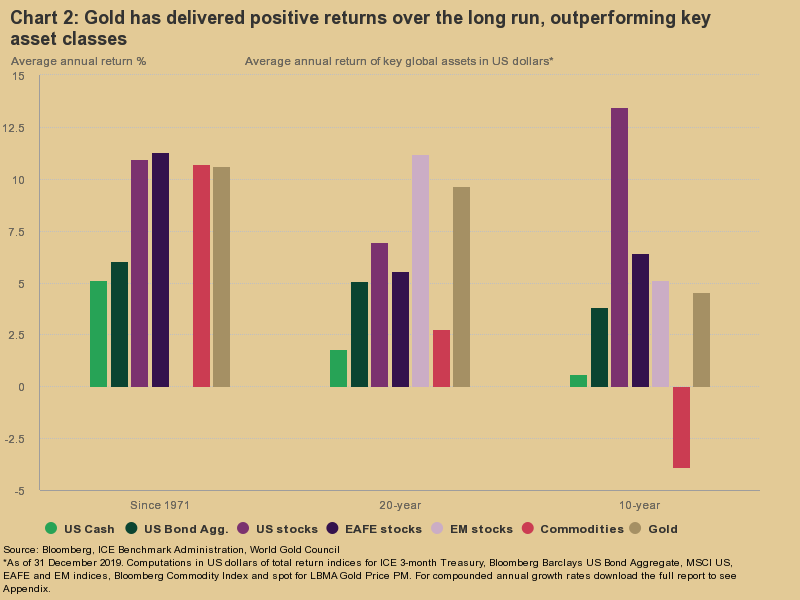

Historically, Gold Outperforms stocks

Since 2000, Gold has outperformed the Dow Jones, S & P 500, and U.S. Bonds by over +275% returns.

The relevance of gold as a strategic asset, 2020 edition

Gold is highly liquid, no one’s liability, carries no credit risk, and is scarce, historically preserving its value over time.

Historically, Gold Outperforms stocks

Since 2000, Gold has outperformed the Dow Jones, S & P 500, and U.S. Bonds by over +275% returns.

The relevance of gold as a strategic asset, 2020 edition

Gold is highly liquid, no one’s liability, carries no credit risk, and is scarce, historically preserving its value over time.

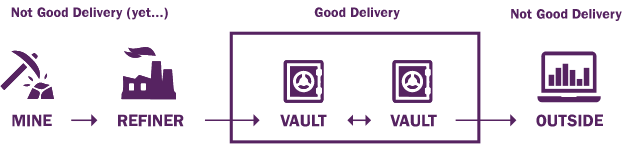

Importance of “Good Delivery” Standards

PAI only provides investors with access to investment grade “Good Delivery” precious metals options.

Good Delivery

The global OTC market for precious metals is dependent on the fungibility of bars that underpin the system. Only gold and silver bars that meet LBMA’s Good Delivery standards are acceptable in the settlement of a local London contract. LBMA sets the global standard for these bars through the maintenance of the London Good Delivery Lists.

Responsible Sourcing

LBMA’s Responsible Sourcing Program was set up to consolidate, strengthen, and formalize existing standards of refiners’ due diligence.

The scope of the Guidance documents not only meets but exceeds, conflict minerals regulations. Refiners are audited annually and are required to report publicly.

Understanding Gold Valuation

Understanding Gold Valuation

Investing in Precious Metals does not conform to most of the common valuation frameworks used for stocks or bonds. Without a coupon or dividend, typical discounted cash flow models fail. And there are no expected earnings or book-to-value ratios either. Our research shows that, in fact, valuing gold is intuitive: its equilibrium price is determined by the intersection of demand and supply. In particular, gold’s performance can be explained by four broad sets of drivers:

Investing in Precious Metals does not conform to most of the common valuation frameworks used for stocks or bonds. Without a coupon or dividend, typical discounted cash flow models fail. And there are no expected earnings or book-to-value ratios either. Our research shows that, in fact, valuing gold is intuitive: its equilibrium price is determined by the intersection of demand and supply. In particular, gold’s performance can be explained by four broad sets of drivers:

Economic Expansion

periods of growth are very supportive of jewellery, technology and long-term savings

Risk and Uncertainty

market downturns often boost investment demand for gold as a safe haven

Opportunity Cost

the price of competing assets, especially bonds (through interest rates) and currencies, influence investor attitudes towards gold

Momentum

investment flows (during risk-on or risk-off periods), positioning in derivatives markets and price trends can ignite or dampen gold’s performance

How you can invest in bullion via PPM

When you buy from PAI the “weight” of your purchase (expressed in grams) will dictate what price PAI (and you) pay. There are simply three fees that apply to investing in precious metal:

- at the time of buying,

- to store the consignment in a secure vault, and

- at the time of selling.

This pricing is pegged to the international LBMA spot rate of gold and is only available to institutional investors (like PAI). But by going through PAI, we can pass these savings on to YOU too.

For more information on PAI’s fee structure, fill out PPM Contact Form.

Contact Us for PPM Pricing

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.